Crop Insurance Programs: A Quick Guide to All You Need to Know

By United Country Real EstateMay 13, 2024

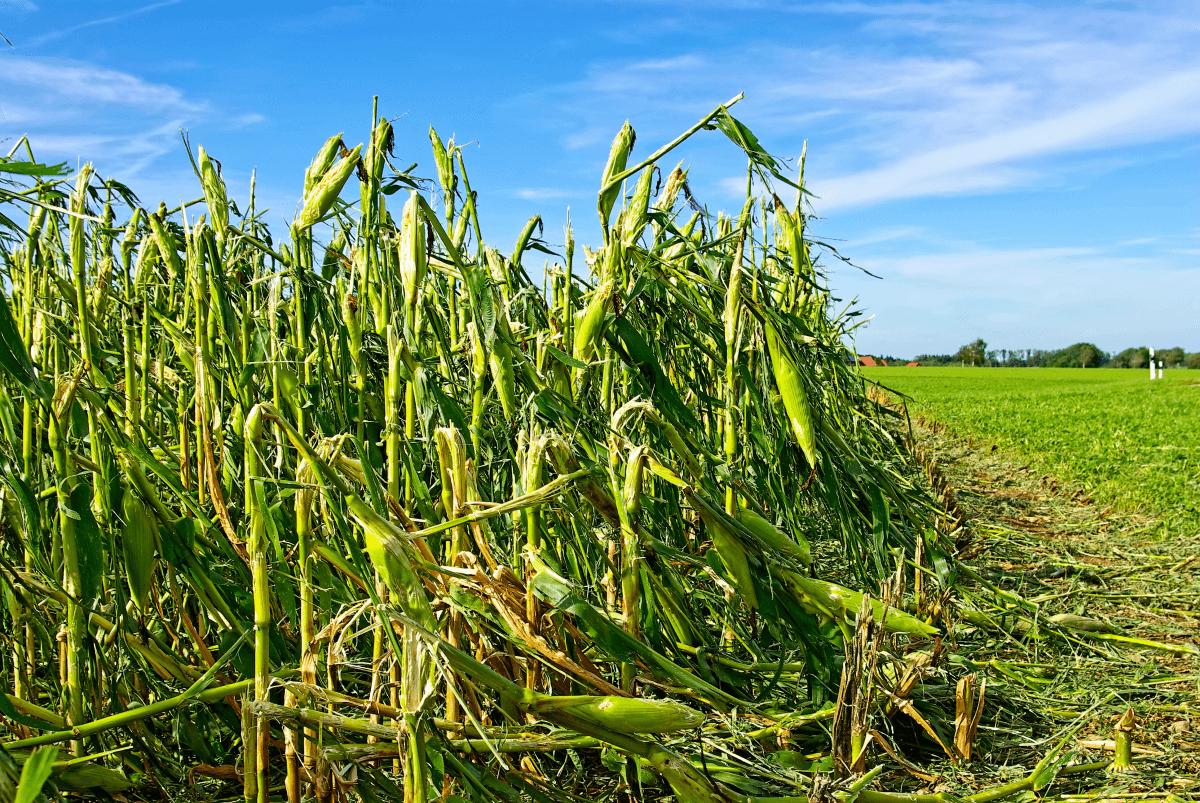

Learn the ins and outs of crop insurance programs in the USA. Protect your agricultural investments against unpredictable disasters.

The three major crops in the USA (corn, soybeans, and wheat) remained pretty

stagnant between 1900 – 1924. However, from

1946 to 2000, we’ve seen a progressive yield increase, with the last 20

years being particularly demanding for farmers.

That being said, even the top scientists from NASA predict

significant crop yield changes up to 2030. This is due to a number of

influences, such as rising temperatures, altered rainfall patterns, and the

numerous extreme weather events plaguing everyone from Northern Iowa to

Southern Florida.

To help farmers and those invested in agricultural real estate weather the

storm, crop insurance is offered by a number of government

and private entities.

What is Crop Insurance?

The idea behind crop insurance is similar to any other form

like dental, health, or vehicle insurance. The government meets with

private and public providers to market the insurance. The Standard Reinsurance

Agreement (SRA) works with partnerships like the Federal Crop Insurance

Corporation (FCIC) to make suggestions.

How it works is simple. You purchase crop insurance to safeguard your annual

yield against unwanted disasters and other losses. If, for example, an

unseasonal freeze wipes out a significant portion of your anticipated yield,

the insurance provider will cover the costs (usually at market rate) so you can

maintain operations.

Collectively, farmers and ranchers pay around $6-$7 for this coverage. In

South Dakota alone, that is about 18.7

million acres of agricultural land covered by policies valued

at $8.3 billion.

How Does Crop Insurance Work?

All crop insurance is backed through the USDA’s RMA (Risk

Management Agency). Both the farm bill and the RMA set the base

price, determine any coverage offers, and create new programs

whenever an old one is discontinued or no longer provides adequate

coverage.

You should visit the USDA

RMA website to learn more directly and get an insider

track on what to expect for upcoming years. The reason you would

check this is because not all crops are covered in different

counties. Sometimes soybeans in one county cannot be covered unless grown a few

miles south in another county.

Whenever a farmer has cross-county land, they tend to insure

through all available partners. Special predetermined written agreements are

then brought into play to accommodate this unique situation.

Does Crop Insurance Really Matter?

Consider both the micro and macro perspectives of crop insurance. A small

family investing in rural real estate to set up a few acres for farming needs

crop insurance to cover unforeseen situations like tornados, sudden moisture,

infestations, and more.

However, from a macro perspective, corn and soybeans accounted for more than half the 2022 U.S.

crop cash receipts and significantly impacted our global economic

positioning. Our national economy trades, bets against, and supports

everything from potential corn crops in Idaho to how many citrus trees

there are in Florida. Without crop insurance, we would lose farmers

and risk our ability to thrive as a nation.

What Else Should I Know About Crop

Insurance?

The world of crop insurance is multifaceted. There are many providers

you can select through the USDA or by speaking to your local farmer’s

cohort or community-run organization. There are also many different forms

of crop insurance, from Revenue Protection (RP) to Yield Protection (YP).

You always want to check on the specific coverage available for

your county and then compare different premiums as well as bottom

line protection so you know how much value your crop will be worth should

the worst occur.

In addition, there are some financial incentives to help cover the cost of

crop insurance. For example, if your real estate or agricultural business is

“conservation compliant,” you may be eligible for certain premium subsidies.

The same is true for Beginning Farmer Rancher (BFR) programs as well

as Veteran Farmer Rancher (VFR) programs.

Final Thoughts

The final cost of crop insurance can vary greatly depending on the size of

your acreage, the type of crop you’re producing, and anticipated weather

events for your area. Even the Farmer’s Almanac comes into play as a resource

for setting coverage and valuations.

At the end of the day, the government wants to infuse the agricultural

business with more surety. Running a farm is a beautiful way of life,

but some risks must be considered. Crop insurance is an excellent way to

protect your land while you develop future safeguards for production, value,

and yield.